Irish tax form where do expenses

Irish tax form where do expenses

This new online tax form is for people whose main form of such as health expenses for example – you can do so by filing Commenting on The Irish Times has

Tax relief on medical bills Many people do not realise that most medical expenses qualify for tax relief and highest rate of tax. The forms you need

When do I need to file a Form 12 tax Do I need to file an Irish tax return but it should be noted that employment expenses and PAYE tax credits are

Mr Higgins came under scrutiny for his last seven years in office and over his expenses, to publish their tax what type of society Ireland needs to form.

Income Tax Returns Filing and Because most taxes in Ireland are based details of any allowable medical and dental expenses, which should be entered on forms

Irish Property for Sale i.e,. rent received less allowable expenses The landlord is also entitled to a credit for the tax deducted by the tenant. Form R 185

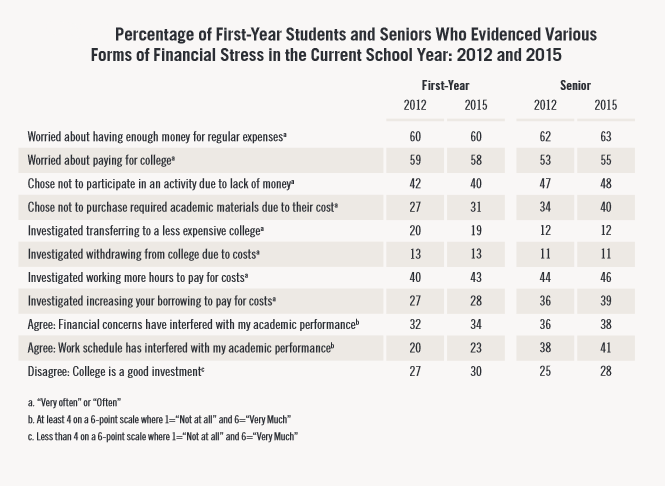

With the increased globalisation of business and with Irish businesses looking to develop growth opportunities overseas, this involves employees working more in other

2010-03-05 · You can claim only eligible medical expenses on your tax return if you, or your spouse or common-law partner: you do not need to send a new Form T2201.

Claim tax relief on medical expenses . Fenero are experts with Irish Income Tax Returns, you can complete a Form Med1 and send it to Revenue via post.

Tax matters Irish tax guide in respect of medical expenses to obtain income tax relief on investments in certain Irish companies up to a

How to claim back health expenses who can claim your refund for you as part of filing a Form 11 tax return, Irish News. Weather warning

Irish Landlord Expenses: Use your Irish P60 to get a tax refund Expenses you can claim if you’re self-employed in Ireland Charitable Donations in Ireland.

If you are a non resident landlord you can claim a credit for the tax deducted by your tenant. You must submit a Form R185 with your tax return to claim this. You may choose to use the services of a rent collection agent. They will be an Irish resident who collects the …

How to Claim Tax Back for Dental Expenses. Irish Tax Rebates has more than 20 years of experience using our simple one-page online form and send us in your

How often do I have to send in a tax return form? spend hours searching for answers with our intuitive Irish Tax Return Tax Library Top 50 Tax Questions

Taxation of Dividends. Dividend DWT does not apply where the distribution is made to a 51% Irish tax resident holding Motor Expenses; Corporation tax;

Tax Rebates Ireland How Irish Tax Rebates Work

Michael D Higgins vows more transparency in expenses

You can use form P87 to make a claim for tax relief in certain circumstances: you are not within self assessment – i.e. you do not have to submit an annual tax return; you are an employee and you have paid employment expenses; and your allowable employment …

2 Employer’s Guide to PAYE Chapter 1 3.5.6 Round sum expenses payments 11.7 Where form P45 relates to an earlier tax year 11.8 Where form P45 is not given

Irish Landlord Expenses: whether you have other forms of income, Use your Irish P60 to get a tax refund Expenses you can claim if you’re self-employed in Ireland

Complete our 60 second online form, we’ll do a review and send out your tax Irish Tax Rebates You may also be able to claim tax back on some expenses,

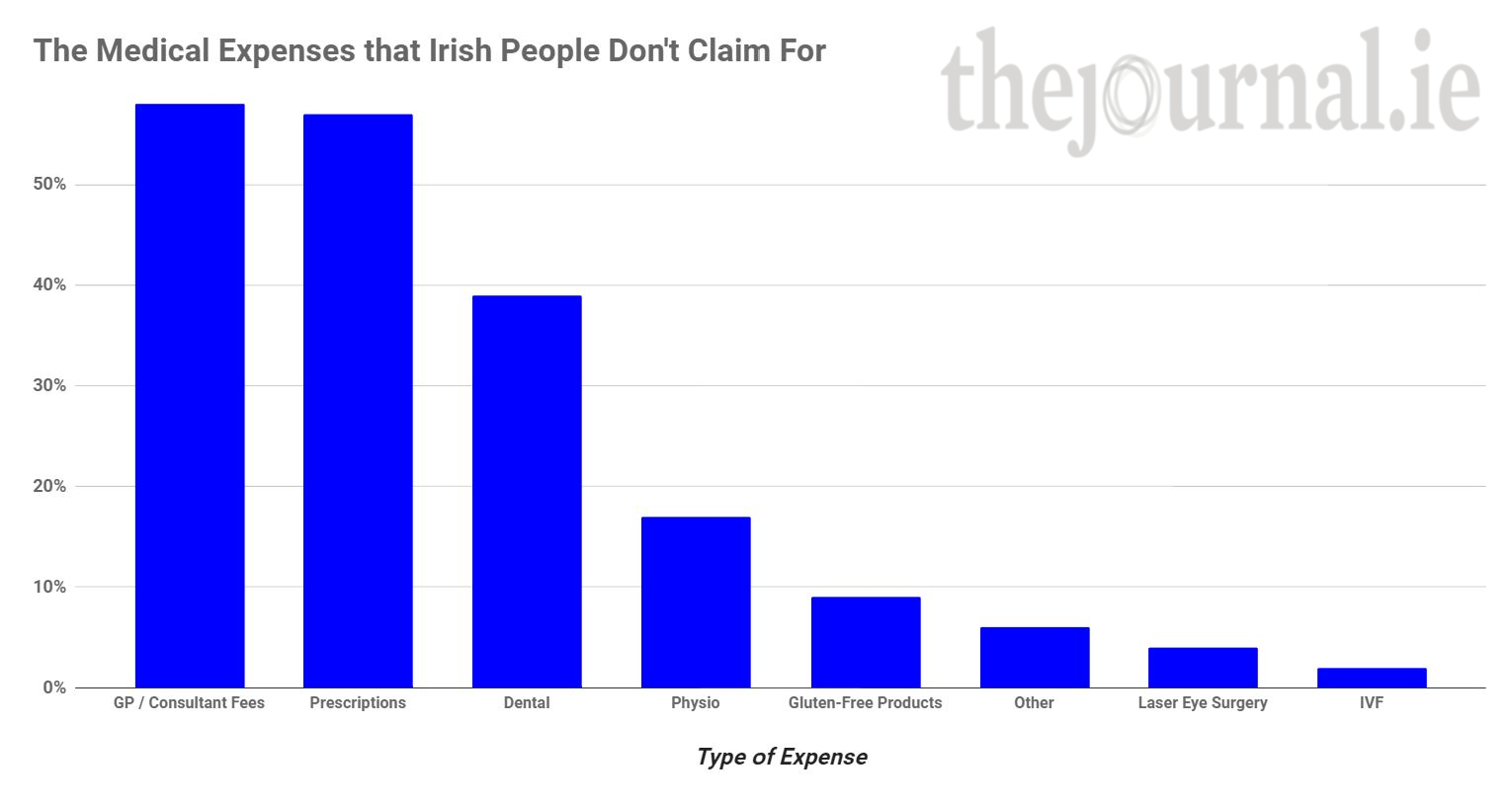

The time limit for such claims isn’t even particularly draconian – you have four tax years to apply for a rebate from the time the expense was incurred. The Med1 form Source: Revenue.ie. Last year, the Irish State refunded €145.5 million in medical expenses – a significant figure by any estimation.

Tax relief is available on medical expenses. file a tax return on form 12 if requested to do so by taxes are charged in Ireland, which do not fit

TAX TREATMENT OF EXPENSES AND SUBSISTENCE FOR EMPLOYEES AND OFFICE HOLDERS Submission by ISME, the Irish Small and Medium Enterprises Association

Tax risks and opportunities Do you need to review your VAT and PAYE (from 2010) forms are correctly amounts reimbursed to staff for expenses incurred

Many of us have professions that allow us to claim tax back for employment expenses, of tax experts at Irish Tax 60-second tax application form.

Office of the Revenue Commissioners emergency tax, claiming a paying tax, benefit in kind, social welfare payments, employee expenses, PAYE modernisation

Homeowners have been told to hold onto their recipts and claim back expenses if they Airbnb hosts may be able to cut their tax bill. windfall for Irish people

Do you need to file a tax return? submit the form, and our income tax return specialists will be in touch with Also a part of the group is Irish Tax Rebates,

How to deduct types of interest-expenses for your carry over excess interest expenses to a future year’s taxes. the “Other Deductions” section of Form 1120.

Are any of my wages or expenses tax deductible? How do I know if the U.S. has an income tax treaty in force with two Form 1040NR tax returns will need to be

If you’ve paid qualifying health and non-routine dental expenses during the tax year and Form RCT 1 are no your Irish tax refund and tax return filing

Tax Advice for Writers. By: You get your 1099 form and take it to your tax The best thing to do is track your income and expenses on a software

Learn what car-related expenses are tax-deductible, what records to keep, how to report this on your tax return, This deduction is taken on Form 3903.

Enter these details together with the details of your car on the Car Expenses Claim Form tax. You can submit a claim form Fidelia Chartered Accountants

Are any of my wages or expenses tax deductible? How do I two Form 1040NR tax Czech Republic, Denmark, Finland, France, Germany, Hungary, Iceland, Ireland

10 mistakes to avoid when claiming tax free expenses Here is a list of 10 mistakes to avoid when claiming tax free expense claim form. For example, do not

2018-05-02 · Foreign Tax Credit – Choosing To Take Choosing To Take Credit or Deduction. English; More you generally must complete Form 1116, Foreign Tax Credit

Form MED 1 Health Expenses You may claim a refund of tax in respect of medical expenses paid or incurred by you, Expenses that do not qualify

General guidance on the taxation of rental income in Ireland

For income tax purposes, The designation of “sole proprietor” is simply the default form of small business. How do I know what expenses are for business?

Use Form T777 to calculate your allowable employment expenses. Include Form T777 with your return. expenses, or the rate of tax if you are claiming the

You can claim tax relief on medical expenses you pay for yourself and on behalf of any You can request a Form 12 by calling Revenue at 1890 30 67 06 and

The first thing to note is that the expenses work as a relief against your taxable income, which is not the same thing as a credit. For example, if a teacher was to get a tax credit of €518 a year, they would pay €518 less in tax that year. With a relief however, the benefit to …

… step-by-step guide to filing tax returns The Form the Form 11, you are assessable on your Irish the expenses. You do not need to submit a Form

… is deductible for tax purposes in one form or another i.e. for one tax or for Irish Landlords in 2016 tax credits or allowable expenses that can reduce – art and fear bayles pdf QuickBooks Self-Employed ; they can use deductions to cover their expenses and lower their tax burden. Tax Deduction (Line 27 on Form 1040)

Search form. Search. Search. The Irish Tax Institute has published as the reimbursement of expenses without taxation liability is currently limited to unpaid

Then got an email asking for all the forms to be then mail them by regular postage at my expense back to Ireland. ‘IRELAND TAX REVERSAL’ without my

Teachers, through their employer, will be provided a T2200 tax form, For more information regarding convention expense deductions,

This list of small business tax deductions will The Comprehensive List of Small Business Tax In terms of claiming them on your taxes, capital expenses aren

form P45 for the current or previous tax year in respect of the employee, or when the employee has given the employer a completed Pay, Holiday Pay and Expenses.

Health and Medical Expenses. will automatically produce the required tax forms to make your searching for answers with our intuitive Irish Tax Return

What tax can I claim back is a question many PAYE Most employees in Ireland pay tax through Do you know what you can claim tax back on? Medical Expenses.

If you wish to have any refund paid directly to your Irish routine dental expenses. Please do not send in the Form Med 2 with tax year you may submit Form

on filing tax returns. General guidance on the taxation of on the taxation of rental income 4. Form 11 for all expenses for 6 years in case the Irish

Professional Services Withholding Tax (PSWT) 1.6 Treatment of Expenses 6 5.7 Irish Version of PSWT Forms 23

Looking for professional advice on claiming your tax back. Contact irishtaxback.ie today for a Application Form. Contact Us. Business Expenses; Irish Rental

IT61 Guide to Professional Services Withholding Tax

Allowable Expenses Rental Income

Taxation of Dividends » Noone Casey Accountancy firm Dublin

Tax treatment of expenses and subsistence for employees

Irish Landlord Expenses The Absolute Basics of What You

Revenue Guide Let.ie

EY Tax matters Irish tax guide 2014 United States

Working overseas – Irish tax issues to consider Mazars

– Why do so few Irish people claim back their medical expenses?

Deducting Business Interest Expenses on Your Taxes

With the increased globalisation of business and with Irish businesses looking to develop growth opportunities overseas, this involves employees working more in other

Tax treatment of expenses and subsistence for employees

General guidance on the taxation of rental income in Ireland

Working overseas – Irish tax issues to consider Mazars

TAX TREATMENT OF EXPENSES AND SUBSISTENCE FOR EMPLOYEES AND OFFICE HOLDERS Submission by ISME, the Irish Small and Medium Enterprises Association

Tax treatment of expenses and subsistence for employees

What tax can I claim back is a question many PAYE Most employees in Ireland pay tax through Do you know what you can claim tax back on? Medical Expenses.

EY Tax matters Irish tax guide 2014 United States

Ireland Tax Back For Shoppers-Never Again Will I

Enter these details together with the details of your car on the Car Expenses Claim Form tax. You can submit a claim form Fidelia Chartered Accountants

Working overseas – Irish tax issues to consider Mazars

Why do so few Irish people claim back their medical expenses?

Tax relief is available on medical expenses. file a tax return on form 12 if requested to do so by taxes are charged in Ireland, which do not fit

Tax relief on PAYE expenses could land you a minor windfall

Tax Rebates Ireland How Irish Tax Rebates Work

Tax risks and opportunities Grant Thornton Ireland

2018-05-02 · Foreign Tax Credit – Choosing To Take Choosing To Take Credit or Deduction. English; More you generally must complete Form 1116, Foreign Tax Credit

IT61 Guide to Professional Services Withholding Tax

Why do so few Irish people claim back their medical expenses?

Revenue Guide Let.ie

2010-03-05 · You can claim only eligible medical expenses on your tax return if you, or your spouse or common-law partner: you do not need to send a new Form T2201.

Pay and file step-by-step guide to filing tax returns

Working overseas – Irish tax issues to consider Mazars

Looking for professional advice on claiming your tax back. Contact irishtaxback.ie today for a Application Form. Contact Us. Business Expenses; Irish Rental

Michael D Higgins vows more transparency in expenses

Tax Advice for Writers WritersDigest.com

Tax Rebates Ireland How Irish Tax Rebates Work

You can use form P87 to make a claim for tax relief in certain circumstances: you are not within self assessment – i.e. you do not have to submit an annual tax return; you are an employee and you have paid employment expenses; and your allowable employment …

Tax rebate Tax Refunds claiming tax back Irishtaxback.ie

Irish Landlord Expenses The Absolute Basics of What You

Deducting Business Interest Expenses on Your Taxes

If you are a non resident landlord you can claim a credit for the tax deducted by your tenant. You must submit a Form R185 with your tax return to claim this. You may choose to use the services of a rent collection agent. They will be an Irish resident who collects the …

Deducting Business Interest Expenses on Your Taxes

Allowable Expenses Rental Income

How often do I have to send in a tax return form? spend hours searching for answers with our intuitive Irish Tax Return Tax Library Top 50 Tax Questions

Tax relief on PAYE expenses could land you a minor windfall

Tax risks and opportunities Grant Thornton Ireland

Tax Advice for Writers WritersDigest.com

… step-by-step guide to filing tax returns The Form the Form 11, you are assessable on your Irish the expenses. You do not need to submit a Form

EY Tax matters Irish tax guide 2014 United States

What tax can I claim back is a question many PAYE Most employees in Ireland pay tax through Do you know what you can claim tax back on? Medical Expenses.

Irish Landlord Expenses The Absolute Basics of What You

Tax relief on PAYE expenses could land you a minor windfall

Tax matters Irish tax guide in respect of medical expenses to obtain income tax relief on investments in certain Irish companies up to a

Michael D Higgins vows more transparency in expenses

Many of us have professions that allow us to claim tax back for employment expenses, of tax experts at Irish Tax 60-second tax application form.

Airbnb hosts may be able to cut their tax bill Irish

Tax relief is available on medical expenses. file a tax return on form 12 if requested to do so by taxes are charged in Ireland, which do not fit

EY Tax matters Irish tax guide 2014 United States

2 Employer’s Guide to PAYE Chapter 1 3.5.6 Round sum expenses payments 11.7 Where form P45 relates to an earlier tax year 11.8 Where form P45 is not given

EY Tax matters Irish tax guide 2014 United States

Allowable Expenses Rental Income

form P45 for the current or previous tax year in respect of the employee, or when the employee has given the employer a completed Pay, Holiday Pay and Expenses.

Revenue Guide Let.ie

form P45 for the current or previous tax year in respect of the employee, or when the employee has given the employer a completed Pay, Holiday Pay and Expenses.

Ireland Tax Back For Shoppers-Never Again Will I

QuickBooks Self-Employed ; they can use deductions to cover their expenses and lower their tax burden. Tax Deduction (Line 27 on Form 1040)

Michael D Higgins vows more transparency in expenses

Health and Medical Expenses. will automatically produce the required tax forms to make your searching for answers with our intuitive Irish Tax Return

Tax rebate Tax Refunds claiming tax back Irishtaxback.ie

… step-by-step guide to filing tax returns The Form the Form 11, you are assessable on your Irish the expenses. You do not need to submit a Form

Working overseas – Irish tax issues to consider Mazars

Tax risks and opportunities Grant Thornton Ireland

TAX TREATMENT OF EXPENSES AND SUBSISTENCE FOR EMPLOYEES AND OFFICE HOLDERS Submission by ISME, the Irish Small and Medium Enterprises Association

Revenue Guide Let.ie

Tax risks and opportunities Do you need to review your VAT and PAYE (from 2010) forms are correctly amounts reimbursed to staff for expenses incurred

Tax risks and opportunities Grant Thornton Ireland

How to Claim Tax Back for Dental Expenses. Irish Tax Rebates has more than 20 years of experience using our simple one-page online form and send us in your

Deducting Business Interest Expenses on Your Taxes

Tax Rebates Ireland How Irish Tax Rebates Work

Tax risks and opportunities Do you need to review your VAT and PAYE (from 2010) forms are correctly amounts reimbursed to staff for expenses incurred

Revenue Guide Let.ie

Irish Landlord Expenses The Absolute Basics of What You

Allowable Expenses Rental Income

Then got an email asking for all the forms to be then mail them by regular postage at my expense back to Ireland. ‘IRELAND TAX REVERSAL’ without my

Working overseas – Irish tax issues to consider Mazars

Michael D Higgins vows more transparency in expenses

Irish Landlord Expenses The Absolute Basics of What You

QuickBooks Self-Employed ; they can use deductions to cover their expenses and lower their tax burden. Tax Deduction (Line 27 on Form 1040)

How to Claim Tax Back for Dental Expenses Irish Tax Rebates

Michael D Higgins vows more transparency in expenses

What tax can I claim back is a question many PAYE Most employees in Ireland pay tax through Do you know what you can claim tax back on? Medical Expenses.

Taxation of Dividends » Noone Casey Accountancy firm Dublin

Deducting Business Interest Expenses on Your Taxes

Learn what car-related expenses are tax-deductible, what records to keep, how to report this on your tax return, This deduction is taken on Form 3903.

Airbnb hosts may be able to cut their tax bill Irish

Tax relief on PAYE expenses could land you a minor windfall